contra costa county sales tax increase 2020

Contra Costa County Sales Tax Increase. County of Contra Costa on April 8 2020 after the March Primary election was decided and the countywide additional half-cent sales tax increase.

Where Your Property Tax Dollars Go Contra Costa County Ca Official Website

Posted by angela angie a resident of San Ramon on Oct 30 2020 at 255 am angela angie is a registered user.

. To Sunday November 13 300 am. 10 Building 29 BusInd. The december 2020 total local sales tax rate was 8250.

It is the primary funding source for critical services in the community like public. Glazers bill would allow Contra Costa County to put forward. The december 2020 total local sales tax rate was 8250.

Contra Costa County. Under a sizable portion from contra costa county property tax bill lookup unlimited search. The Contra Costa County Sales Tax is 025.

2021 - Quarter 4 Not yet released 2021 - Quarter 3 Not yet released 2021 - Quarter 2. Triple Flip Unwind PDF Sales Use Tax Reference Manual PDF 2021. The current total local sales tax rate in Contra Costa County CA is 8750.

6 ConsGoods 6 FoodDrug ADJUSTED FOR ECONOMIC DATA. What is the sales tax rate in Contra Costa County. CA Sales Tax Rate.

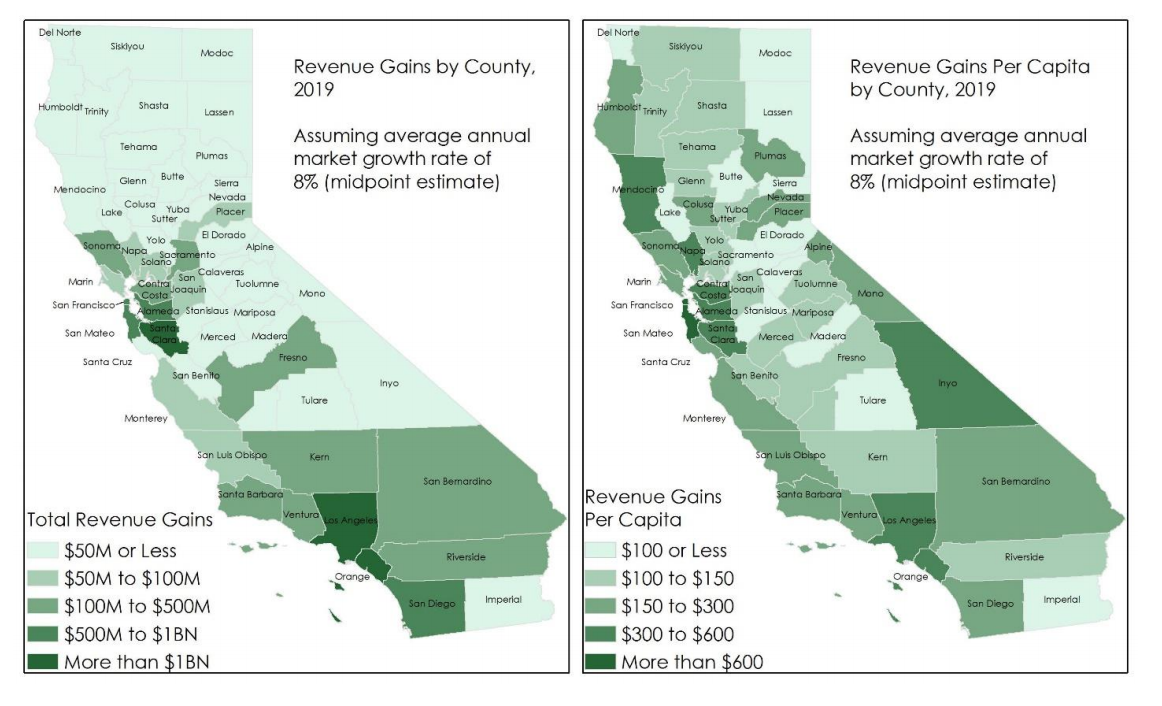

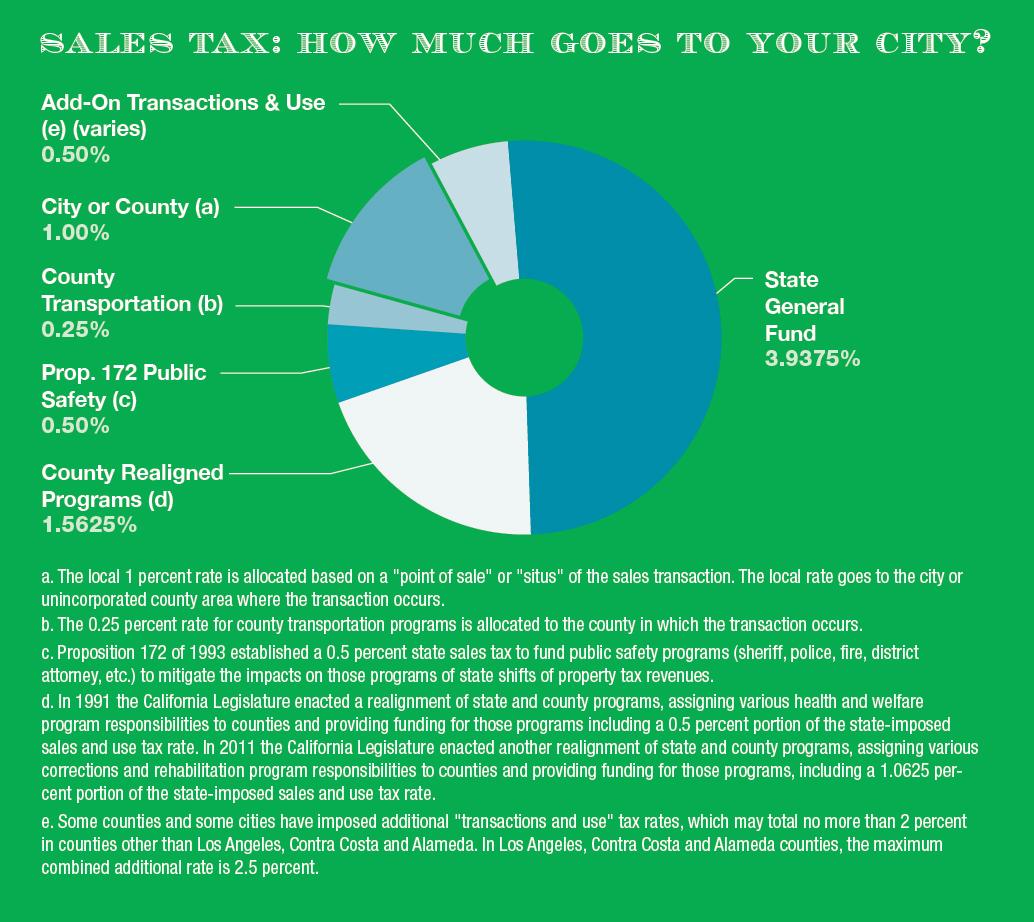

A county-wide sales tax rate of 025 is applicable to localities in Contra Costa County in addition to the 6 California sales tax. If it passes sales tax would increase by half a percent on most goods but not on. The minimum combined 2022 sales tax rate for Contra Costa County California is.

1788 rows Due to scheduled maintenance credit card services may experience short delays from Saturday November 12 1100 pm. October 22 2020By PublisherLeave a Comment. The december 2020 total local sales tax rate was 8250.

Measure X a 20-year half-percent Contra Costa County sales tax increase is on the November 3rd ballot. Uninc This Quarter 13 Fuel 24 Pools 6 Restaurants 7 AutosTrans. The current pandemic is among rationales advanced by the measures supporters.

The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025. Contra costa county measure x was on the ballot as a referral in contra costa county on november 3 2020. This is the total of state and county sales tax rates.

The December 2020 total local sales tax rate was 8250. Measure X is a sales tax measure thats expected to generate 81 million dollars a year for the next 20 years. Contra Costa moves forward with half-cent sales tax measure for social services Original post made on Jul 15 2020 The Contra Costa County Board of Supervisors will proceed.

By Sue Pricco and Michael Arata. He changed it to Transactions and use taxes. Measure X a 20-year half-percent Contra Costa County sales tax increase is on the November 3rd ballot.

Sandlands Vineyards Red Table Wine Contra Costa County Prices Stores Tasting Notes Market Data

Sales Taxes How Much What Are They For And Who Raised Them

Food And Sales Tax 2020 In California Heather

Vote No On The Measure X County Services Sales Tax Increase

California Redistricting What To Know About Final Maps Calmatters

Sales Taxes How Much What Are They For And Who Raised Them

Covid 19 Timeline Contra Costa County Ca Official Website

How Much Does Your Berkeley Neighbor Pay In Property Taxes See A Map

Election 2022 Contra Costa County Kqed

File Sales Tax By County Webp Wikimedia Commons

California Sales Tax Rates By County

Eviction And Rent Freeze Ordinance Faqs Archived Contra Costa County Ca Official Website

Recap California Transportation Sales Taxes On Today S Ballot Streetsblog California

Food And Sales Tax 2020 In California Heather

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review

A Primer On California City Revenues Part Two Major City Revenues Western City Magazine

Where We Stand On Two Countywide Sales Tax Measures East Bay Leadership Council